Boi Report For Llc 2025 Boi Report

Boi Report For Llc 2025 Boi Report. In john’s case, if his llc is confirmed to be inactive based on the outlined criteria, he may not need to file a boi report. Learn more about reporting deadlines.

1, 2025, is not subject to cta reporting requirements and thus is not required to file a boi report. In john’s case, if his llc is confirmed to be inactive based on the outlined criteria, he may not need to file a boi report.

Boi Report For Llc 2025 Boi Report Images References :

Source: thefinancebuff.com

Source: thefinancebuff.com

File FinCEN BOI Report for Your LLC or SCorp, Businesses created before 2025 have until december 31, 2025, to comply.

Source: positivechangepc.com

Source: positivechangepc.com

The Corporate Transparency Act Navigating BOI Reporting in 2025 By, Companies formed or registered in 2025 must file a boi report within 90 days of receiving actual or public notice of their formation or registration.

Source: www.youtube.com

Source: www.youtube.com

How to File a BOI Report for Your LLC (StepByStep) YouTube, 1, 2025, is not subject to cta reporting requirements and thus is not required to file a boi report.

Source: www.taxbandits.com

Source: www.taxbandits.com

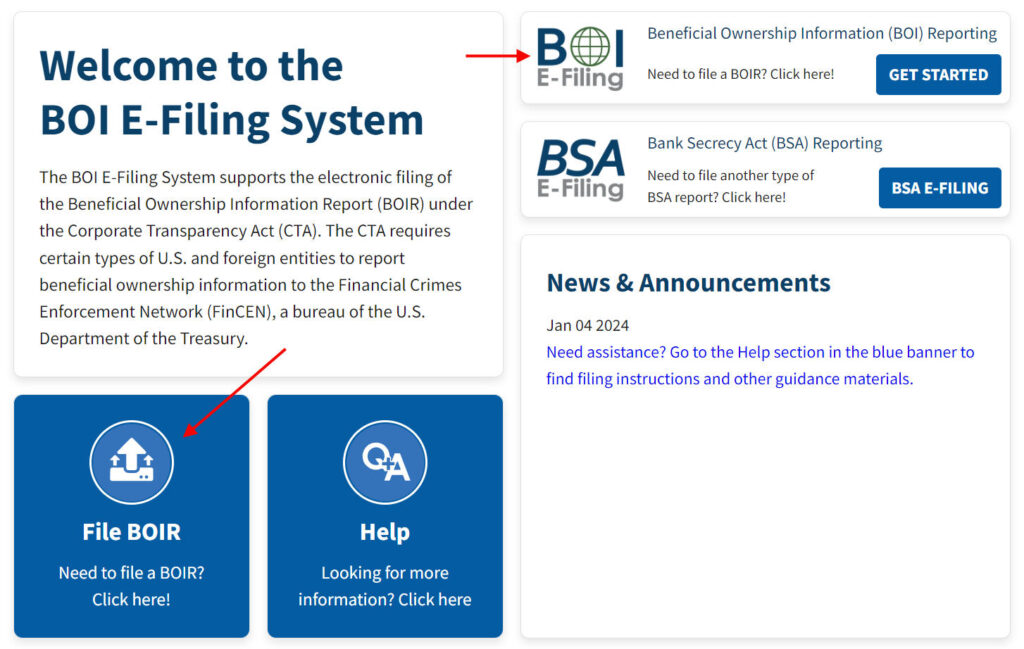

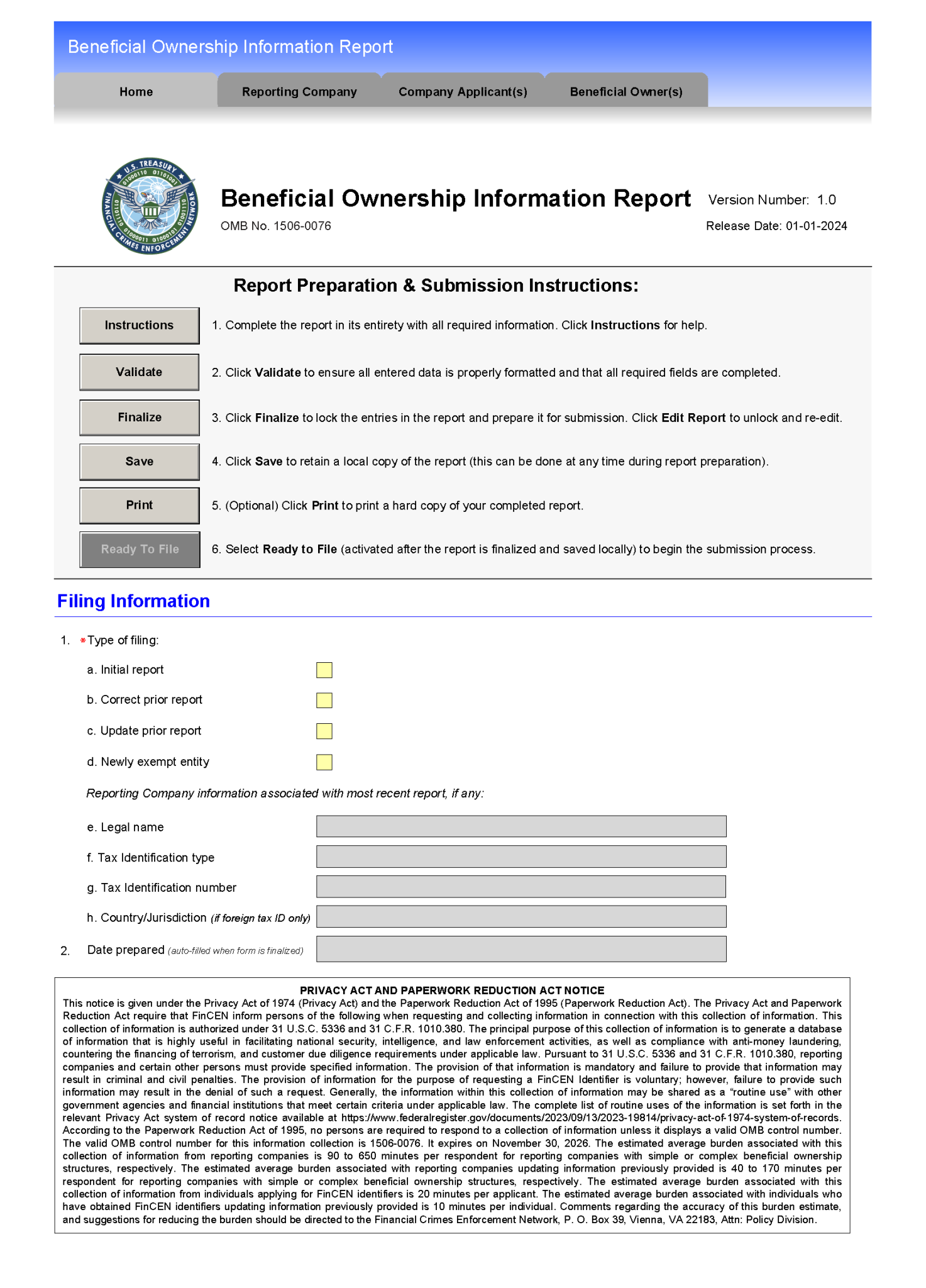

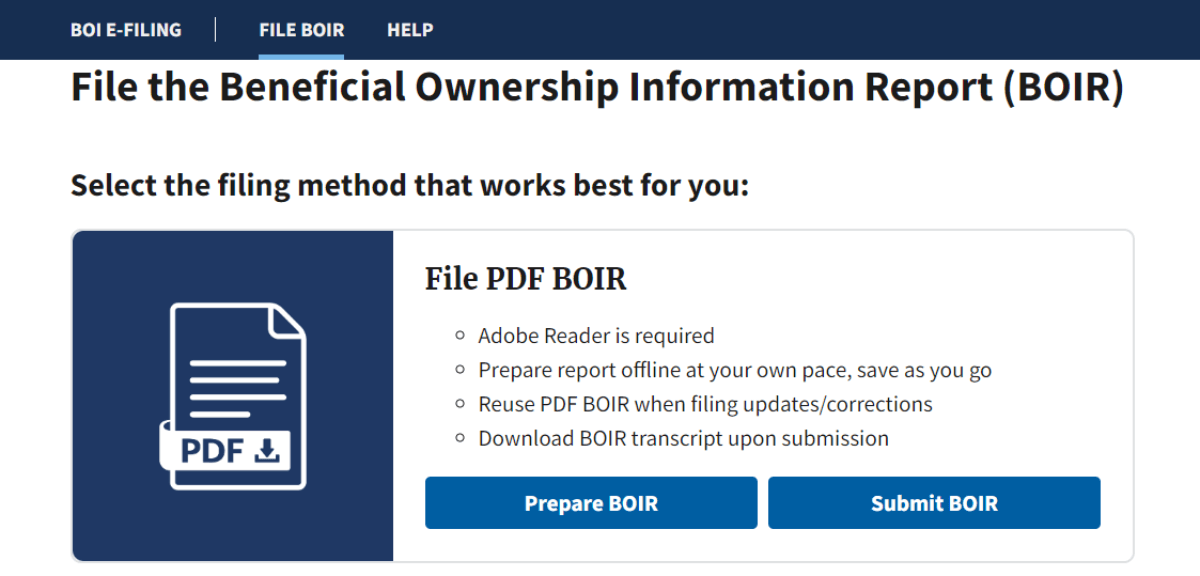

BOI Filing How to File BOI Report Online for 2025, The boi report is filed online in a new federal database called boss (an acronym for beneficial ownership secure.

Source: www.trucklogics.com

Source: www.trucklogics.com

File BOI Report Online for Trucking Business, The rule describes who must file a boi report, what information must be reported, and when a report is due.

Source: legalregistration.com

Source: legalregistration.com

BOI Report for LLC, Beneficial Ownership Information For LLC, Beginning january 1, 2025, the federal corporate transparency act (cta) requires certain types of entities to file a beneficial ownership information (boi) report with the financial crimes.

Source: acuity.co

Source: acuity.co

New Tax Filing Requirement Beneficial Ownership Information, Starting january 1, 2025, certain u.s.

Source: eforms.com

Source: eforms.com

Free Beneficial Ownership Information (BOI) Report PDF eForms, The boi report is filed online in a new federal database called boss (an acronym for beneficial ownership secure.

Source: llcbuddy.com

Source: llcbuddy.com

Corporate Transparency Act and BOI Report Filing (2025 Guide), If your company was created or registered prior to january 1, 2025, you will have until january 1, 2025 to report boi.

Source: boifilings.co

Source: boifilings.co

Homepage U.S BUSINESS COMPLIANCE COMMISSION, Businesses created before 2025 have until december 31, 2025, to comply.

Category: 2025