Colorado Estate Tax 2024

Colorado Estate Tax 2024. State lawmakers consider proposal to lower property taxes in colorado 03:18. Colorado income tax returns are due the fifteenth day of the fourth month after the end of your tax year, or by april 15 for traditional calendar year filers.

Taxes to sell an inherited property: Colorado income tax returns are due the fifteenth day of the fourth month after the end of your tax year, or by april 15 for traditional calendar year filers.

Most Simple Estates, Such As Cash Or A Small Amount Of Easily Valued Assets, Do Not Require The Filing Of An Estate Tax Return.

Estimated tax payments are due:

As Of 2021, The Threshold For The Colorado Estate Tax Is $2.8 Million.

However, you must pay 90 percent of any taxes you owe by.

What Is An Estate Tax And How Does It Work?

Images References :

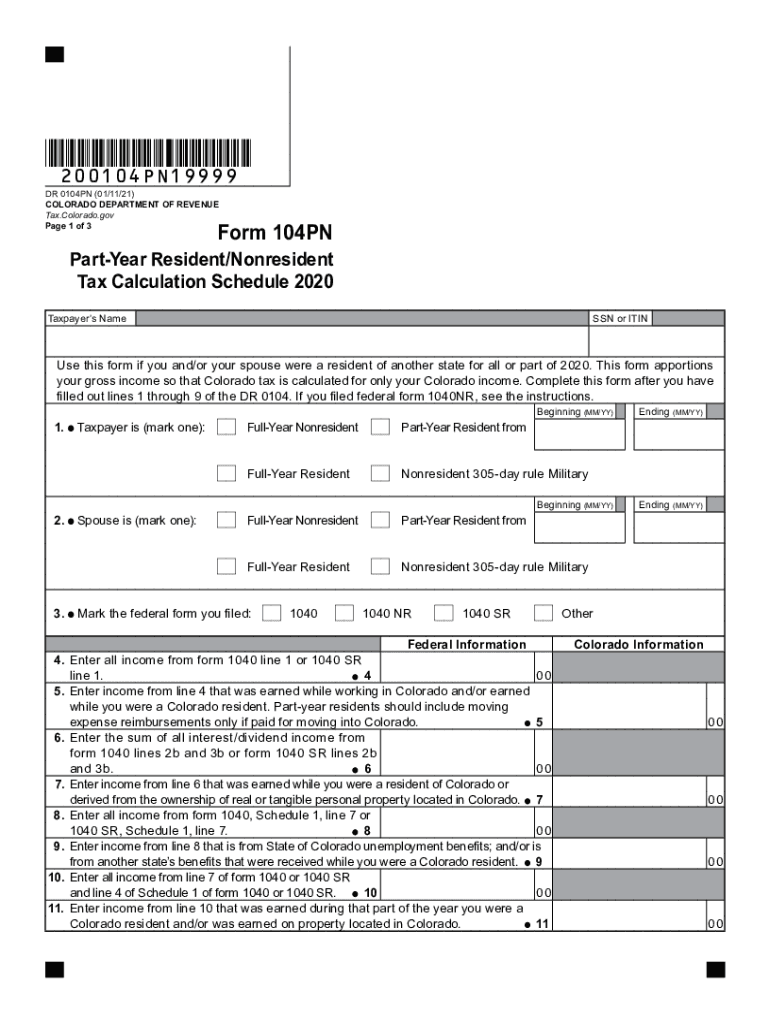

Source: www.dochub.com

Source: www.dochub.com

Colorado form 104pn Fill out & sign online DocHub, The calculator is designed to be used online with mobile, desktop and. The colorado tax calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in colorado, the calculator allows you to calculate income tax and payroll taxes and deductions in colorado.

Source: sukeyqkerstin.pages.dev

Source: sukeyqkerstin.pages.dev

Property Tax Rates By State 2024 Fannie Stephanie, How to avoid inheritance tax in a state where an inheritance tax is imposed. You must file & pay.

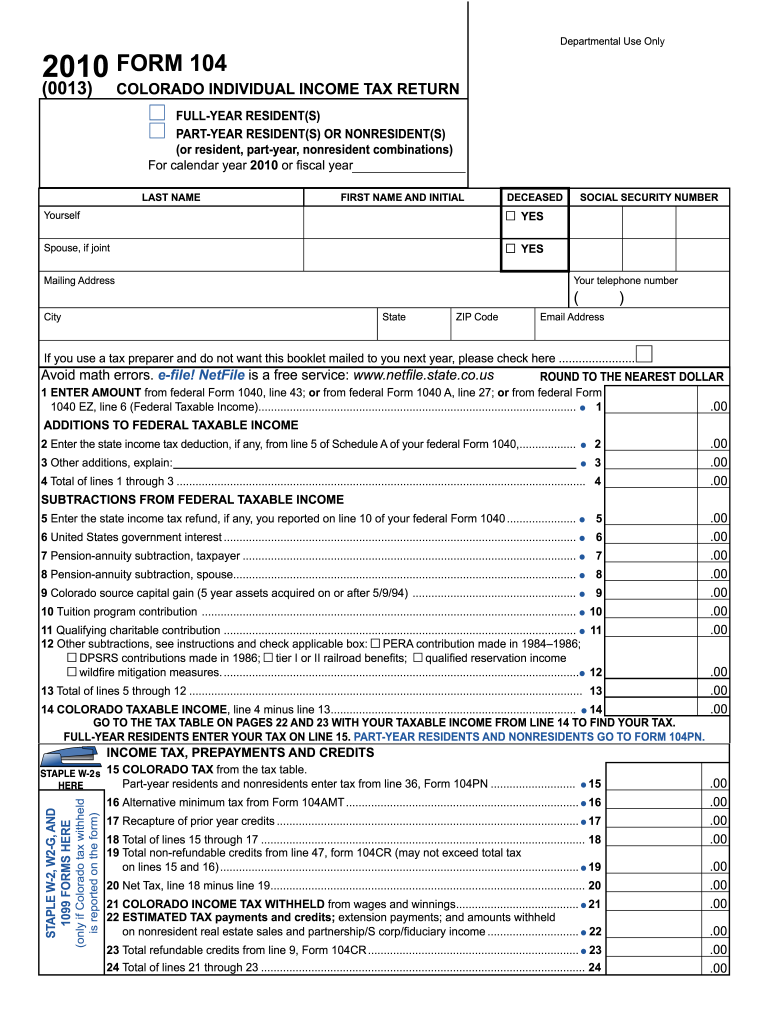

Source: www.dochub.com

Source: www.dochub.com

Colorado form 104 Fill out & sign online DocHub, Estimated tax deadline for colorado 2024. The calculator is designed to be used online with mobile, desktop and.

Source: www.coloradofiscal.org

Source: www.coloradofiscal.org

Colorado's low property taxes Colorado Fiscal Institute, Below is a summary of the states that as of 2024 still impose estate, gift, or inheritance tax: The colorado general assembly’s 2024 legislative session ends may 8.

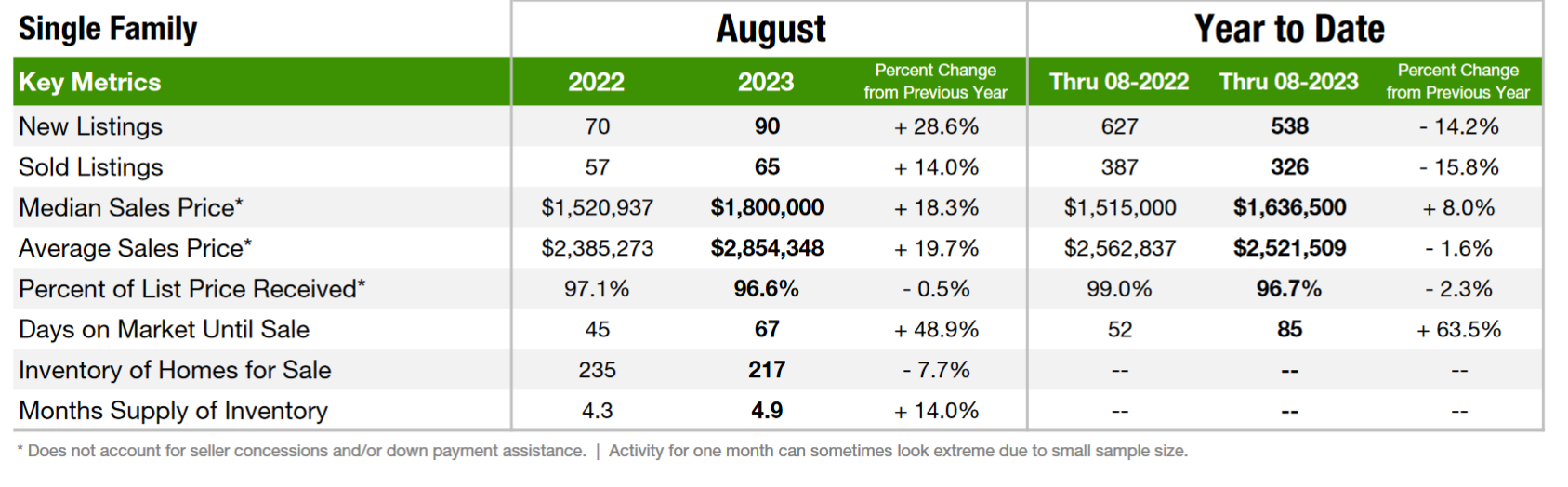

Source: coloradosun.com

Source: coloradosun.com

Colorado property tax calculator How the relief plan would affect your, An estate must have its own form of identification. Colorado gift tax and inheritance tax.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Most simple estates, such as cash or a small amount of easily valued assets, do not require the filing of an estate tax return. The colorado general assembly’s 2024 legislative session ends may 8.

Source: ethelindwlily.pages.dev

Source: ethelindwlily.pages.dev

2024 Tax Chart Irs Wilow Kaitlynn, So you are aware that there is no. You need to pay transfer tax, property tax, and capital gains tax to sell an.

Source: www.urban.org

Source: www.urban.org

Estate and Inheritance Taxes Urban Institute, The colorado tax calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in colorado, the calculator allows you to calculate income tax and payroll taxes and deductions in colorado. Colorado individual tax deadlines for 2024.

Source: coloradohardmoney.com

Source: coloradohardmoney.com

Real Colorado property tax reduction on the ballot in 2024 Colorado, Estimated tax deadline for colorado 2024. The latest a bill could be introduced and still have enough time to.

Source: tiffaniewmegen.pages.dev

Source: tiffaniewmegen.pages.dev

2024 Tax Brackets Mfj Limits Brook Collete, For 2023, the threshold is $12.92 million for individuals and $25.84 million for. That means that if the right legal steps are.

The Annual Salary Calculator Is Updated With The Latest Income Tax Rates In Colorado For 2024 And Is A Great Calculator For Working Out Your Income Tax And Salary After Tax Based On A Annual Income.

Currently, the estate tax in colorado in 2024 is 0%.

For 2024, The Federal Estate Tax Threshold Is $13.61 Million For Individuals, Which Means Married Couples Don’t Have To Pay Estate If Their Estate Is Worth $27.22 Million Or Less.

That would result in a.