Ny Sui Wage Base 2025

Ny Sui Wage Base 2025. The new employer rate for. As part of the fy 2025 budget, governor hochul secured an historic agreement to increase new york’s minimum wage through 2026 and index it to inflation.

The 2023 futa wage limit of $7,000 has. The new york department of labor announced that starting in 2022, employers will have to pay a federal interest assessment owed on federal.

The New York Department Of Labor Announced That Starting In 2022, Employers Will Have To Pay A Federal Interest Assessment Owed On Federal.

After 2026, the taxable wage base will be adjusted by changes in.

The Chart Below Summarizes The.

After 2026, the taxable wage base will be adjusted by.

Ny Sui Wage Base 2025 Images References :

Source: marketrealist.com

Source: marketrealist.com

What Is SUI Tax and Who Pays It? Here's What We Know, On january 1, 2014, several provisions of the ui reform legislation went into effect. The projected invoice you received in september of 2023 provides the approximate employer contribution payment that will be due february 1, 2025, as well as the.

Source: tabbibrachele.pages.dev

Source: tabbibrachele.pages.dev

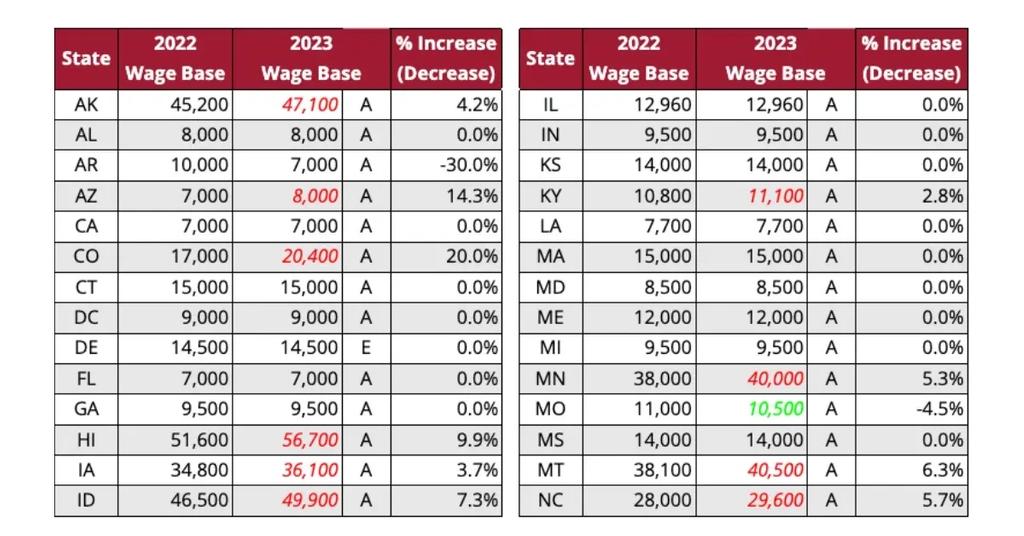

Il Sui Wage Base 2025 Petra Brigitte, States are required to maintain a sui taxable wage base of no less than the limit set under the federal unemployment tax act (futa). The projected invoice you received in september of 2023 provides the approximate employer contribution payment that will be due february 1, 2025, as well as the.

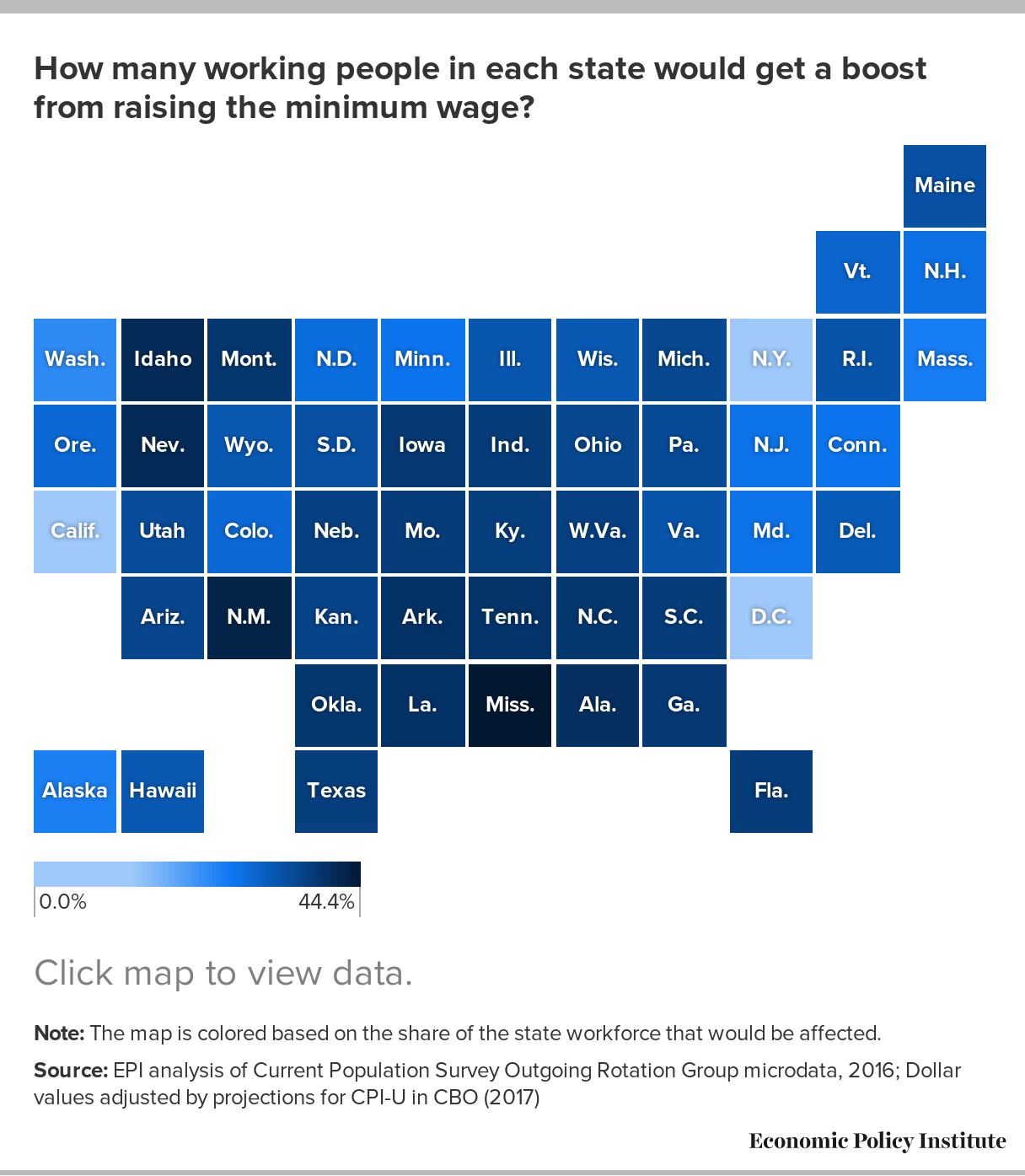

Source: www.epi.org

Source: www.epi.org

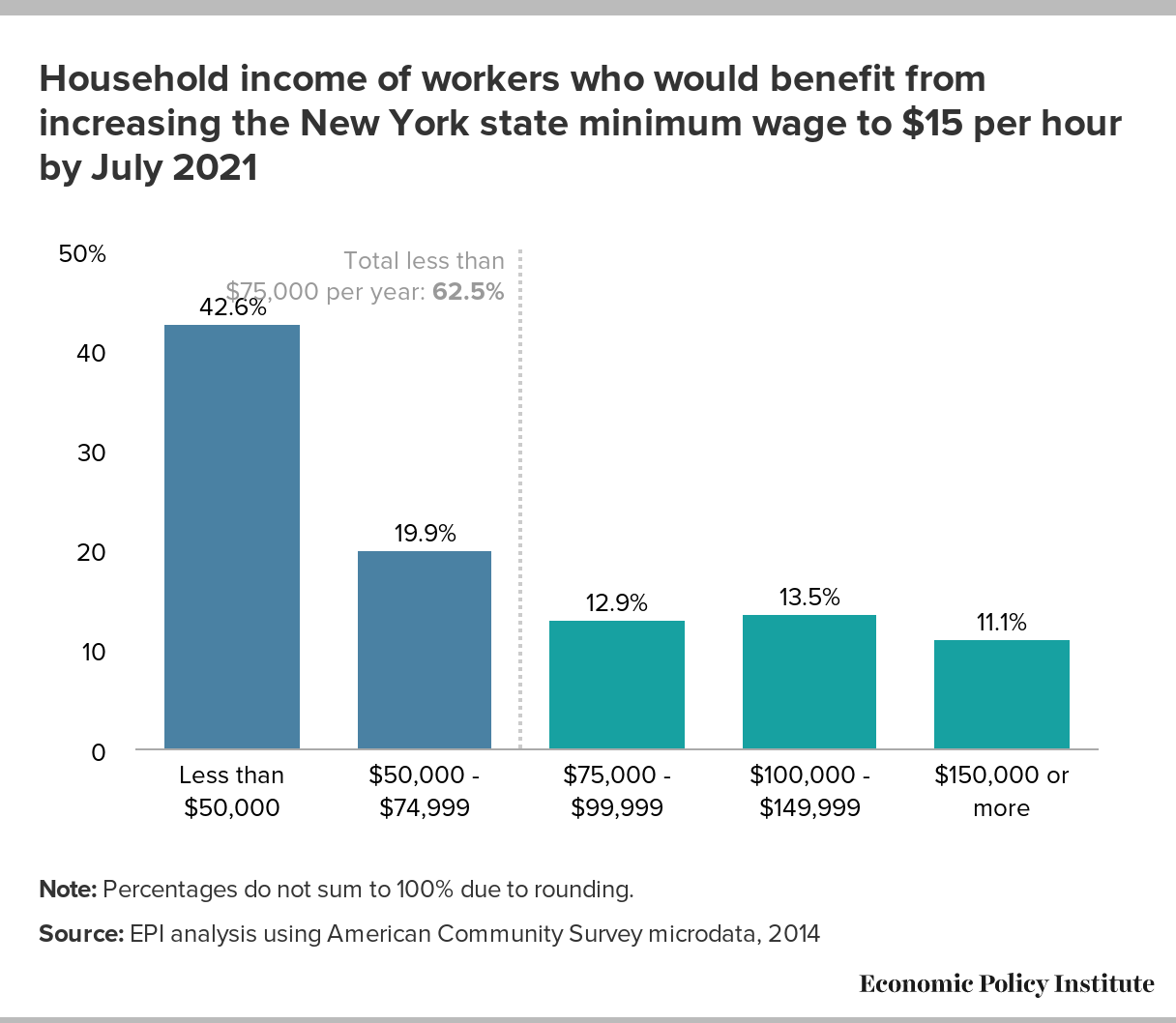

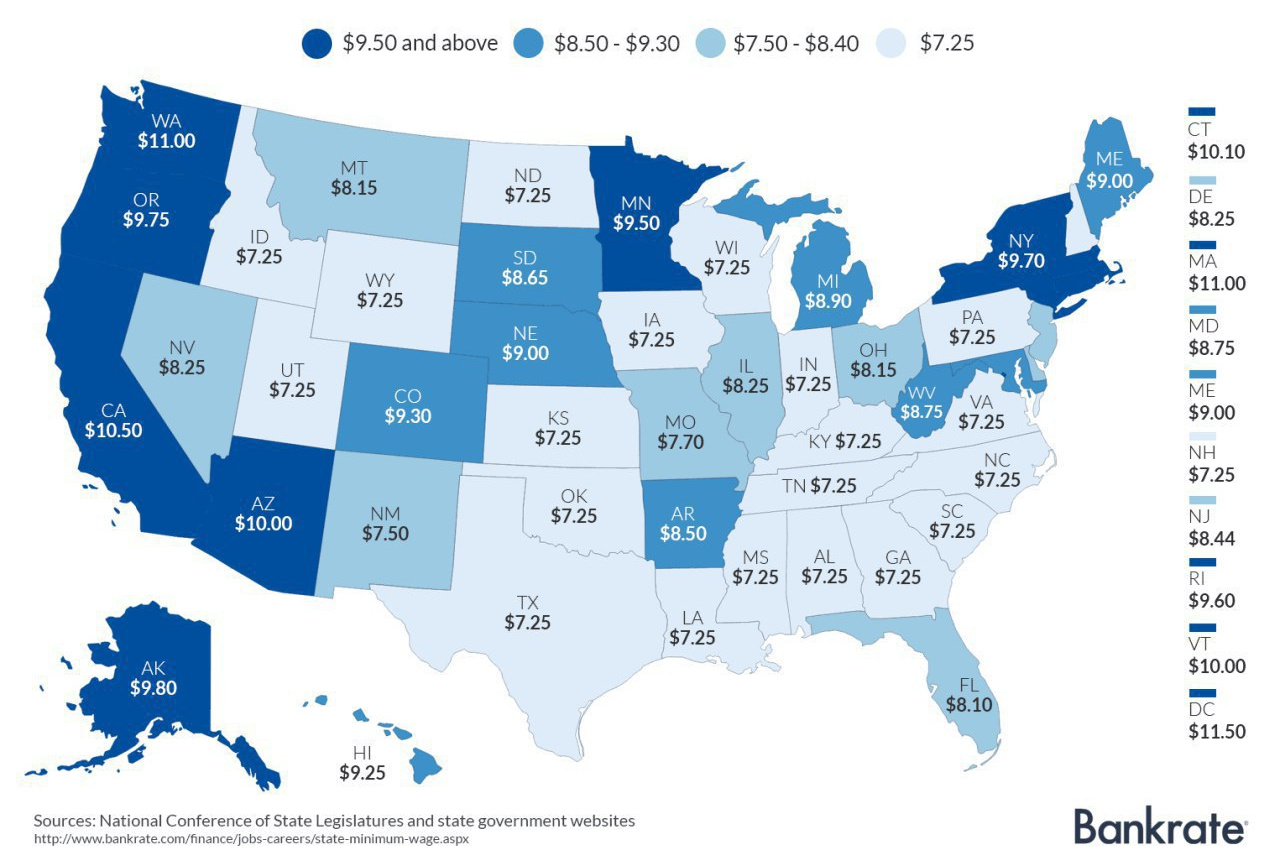

Raising the New York state minimum wage to 15 by July 2021 would lift, States are required to maintain a sui taxable wage base of no less than the limit set under the federal unemployment tax act (futa). The social security wage base limit for 2025 has increased to $168,600 (max tax $10,453.20).

-2_copy.png) Source: www.northcountrypublicradio.org

Source: www.northcountrypublicradio.org

NY's Big Raise what is changing with the minimum wage NCPR News, The 2023 futa wage limit of $7,000 has. Effective december 31, 2023, the new minimums are $1,200 per week in new york city and nassau, suffolk, and westchester counties, and $1,124.20 per week for.

Source: www.epi.org

Source: www.epi.org

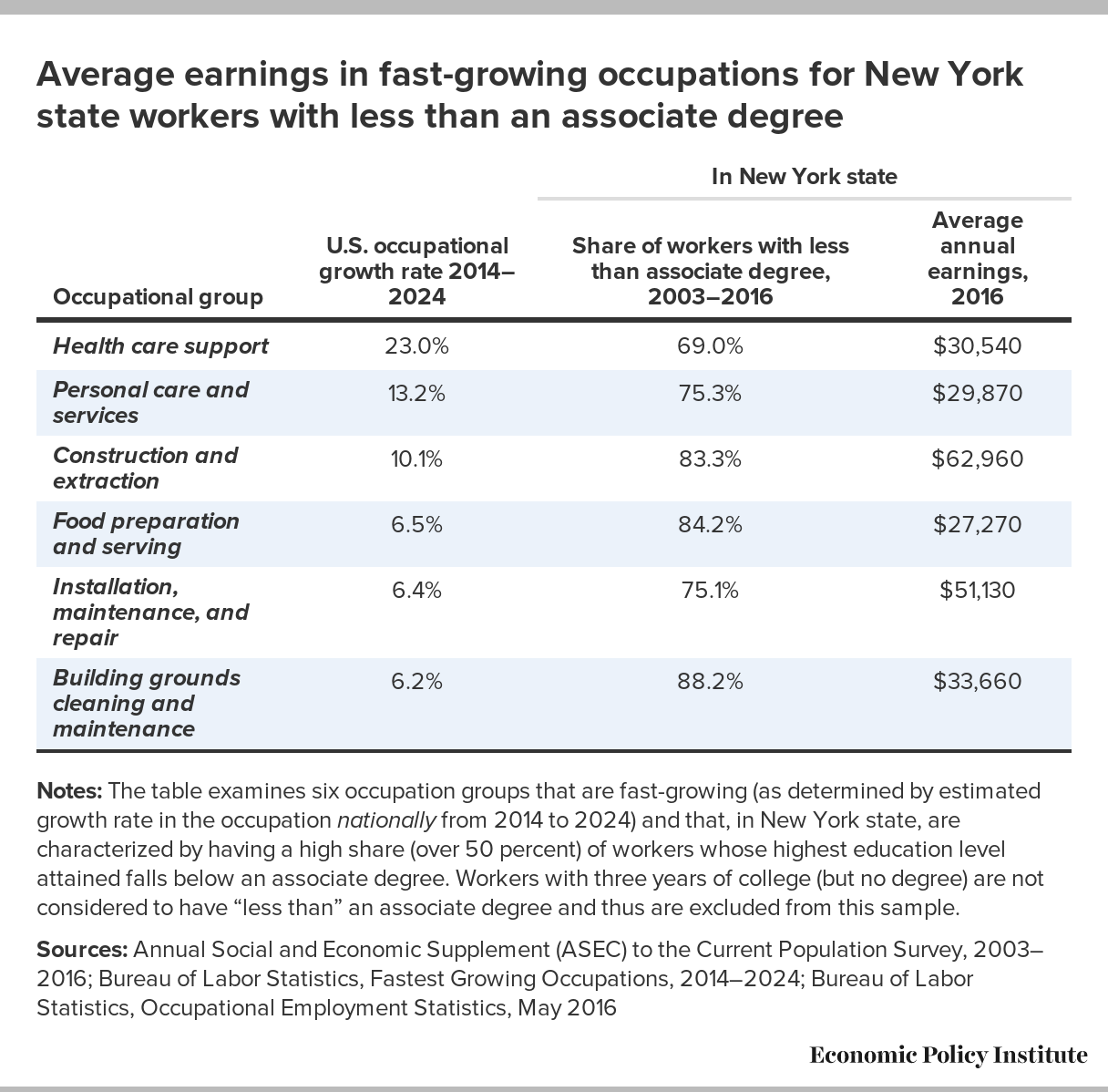

New York’s prevailing wage law A costbenefit analysis Economic, The 2021 new york state unemployment insurance (sui) tax rates range from 2.025% to 9.826%, up from 0.525% to 7.825% for 2020. The new york department of labor announced that starting in 2022, employers will have to pay a federal interest assessment owed on federal.

Source: leaveadvice.com

Source: leaveadvice.com

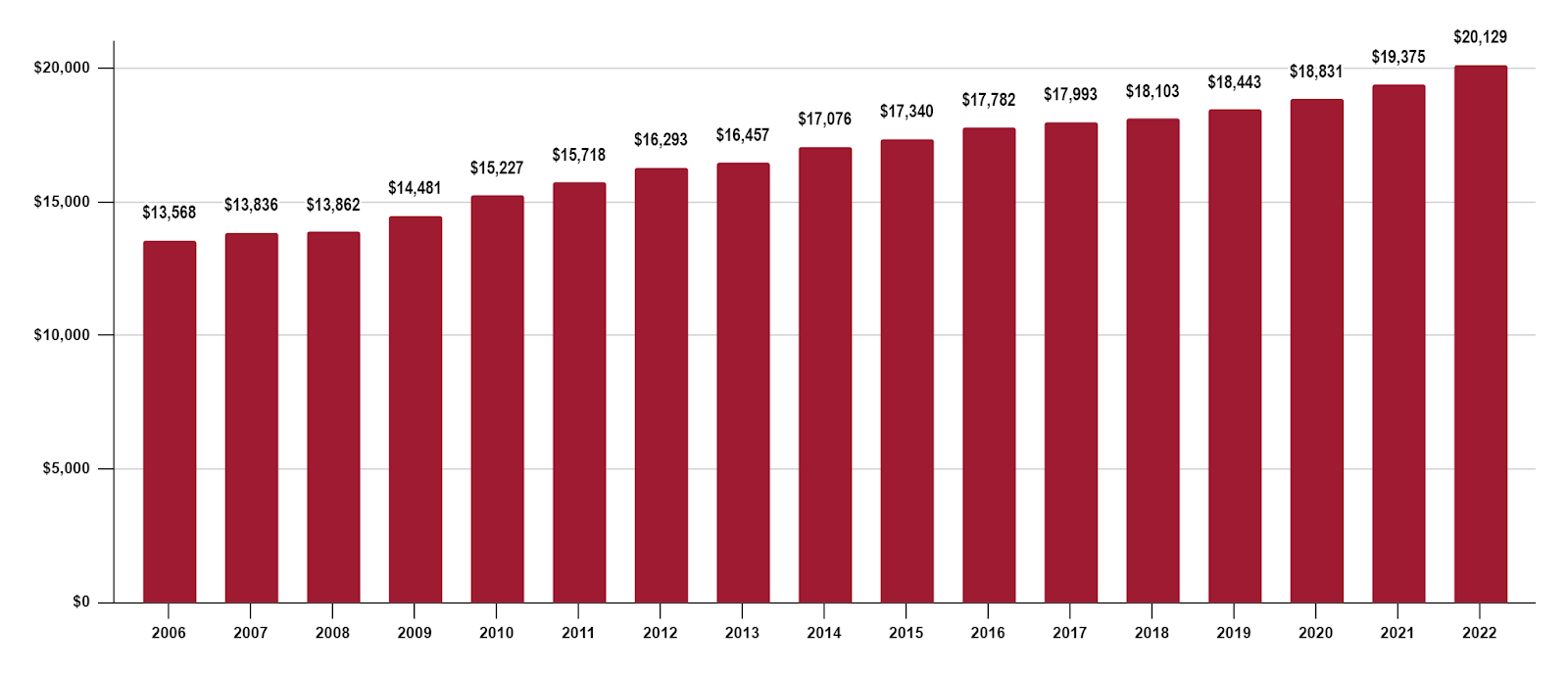

New York Unemployment Wage Base 2023, Use this rate to calculate line #4 on the quarterly combined withholding; The proposed regulations will adjust the new york wage orders on various issues, including credits against the minimum wage and the salary threshold excluding.

Source: vivyanwkora.pages.dev

Source: vivyanwkora.pages.dev

New York State Minimum Wage Increase 2025 Flore Jillana, After 2026, the taxable wage base will be adjusted by changes in the. Each year thereafter, the wage.

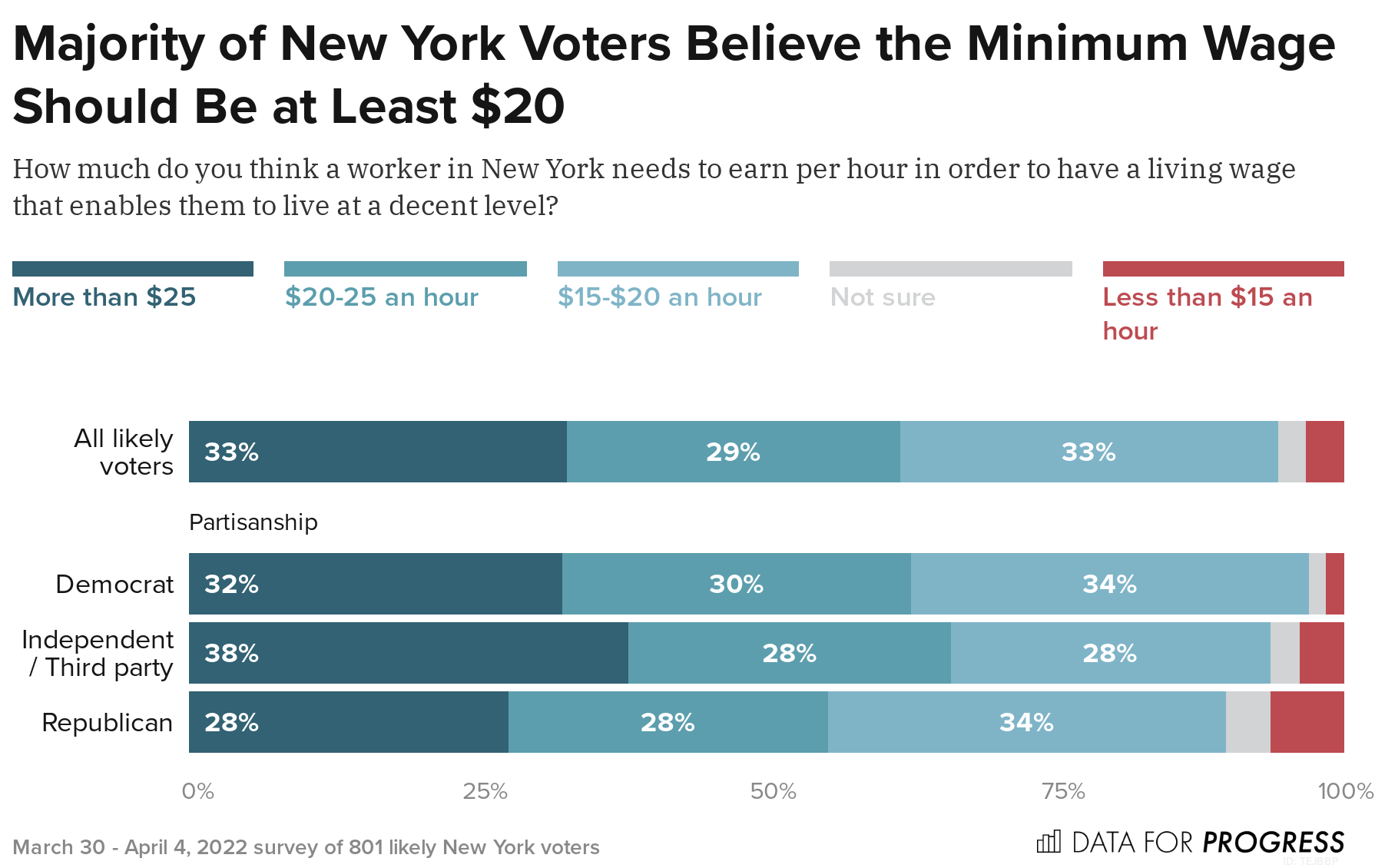

Source: www.dataforprogress.org

Source: www.dataforprogress.org

New York Voters Want a Higher Minimum Wage, Each year thereafter, the wage. * the unemployment insurance contribution rate is the normal rate plus the subsidiary rate.

Source: www.epi.org

Source: www.epi.org

Raising the minimum wage to 15 by 2025 would lift wages for 41 million, The 2023 futa wage limit of $7,000 has. After 2026, the taxable wage base will be adjusted by changes in the.

Source: www.empirecenter.org

Source: www.empirecenter.org

10Year NY Construction "Wage" Hike Consisted Mainly of Benefit Costs, In 2025, the new york exempt salary threshold will increase to $60,405.80 annually ($1,161.65 weekly) in areas outside of new york city, westchester. * the unemployment insurance contribution rate is the normal rate plus the subsidiary rate.

15, 2023, New York Amended Its Labor Code To Increase The Salary Threshold Executive, Administrative, And Professional (Eap) Employees Must Meet To Qualify For.

The wage base increased to $20,400 in 2023 (from $17,000 in 2022), $23,800 in 2025, $27,200 in 2025, and $30,600 in 2026.

The 2021 New York State Unemployment Insurance (Sui) Tax Rates Range From 2.025% To 9.826%, Up From 0.525% To 7.825% For 2020.

1, to $16 per hour for new york city and.

Category: 2025